Online dating has matured into a $6 billion-plus global business—and the data show a widening performance. Tinder still dominates scale and revenue, but 2024 belonged to “relationship-first” challengers Hinge and Grindr, which are expanding faster, delivering higher user satisfaction, and converting free members at record rates. Safety, transparency, and niche targeting have become decisive differentiators, reshaping which apps truly “work best” in 2025.

1. Market Overview: Bigger but More Fragmented

Online dating services grew 15% to roughly $6.2 billion in 2024 worldwide. Tinder, Bumble, Hinge (Match Group), and Grindr account for nearly 60% of that total.

- Global users: 360 million (2024), projected 375 million by 2026.

- Paid subscribers across all apps: ≈14 million (Q1 2025).

- Download growth flat: overall installs fell 2% year-on-year as “app fatigue” set in.

2. Revenue & Growth Leaders

Aggregate results show diverging fortunes:

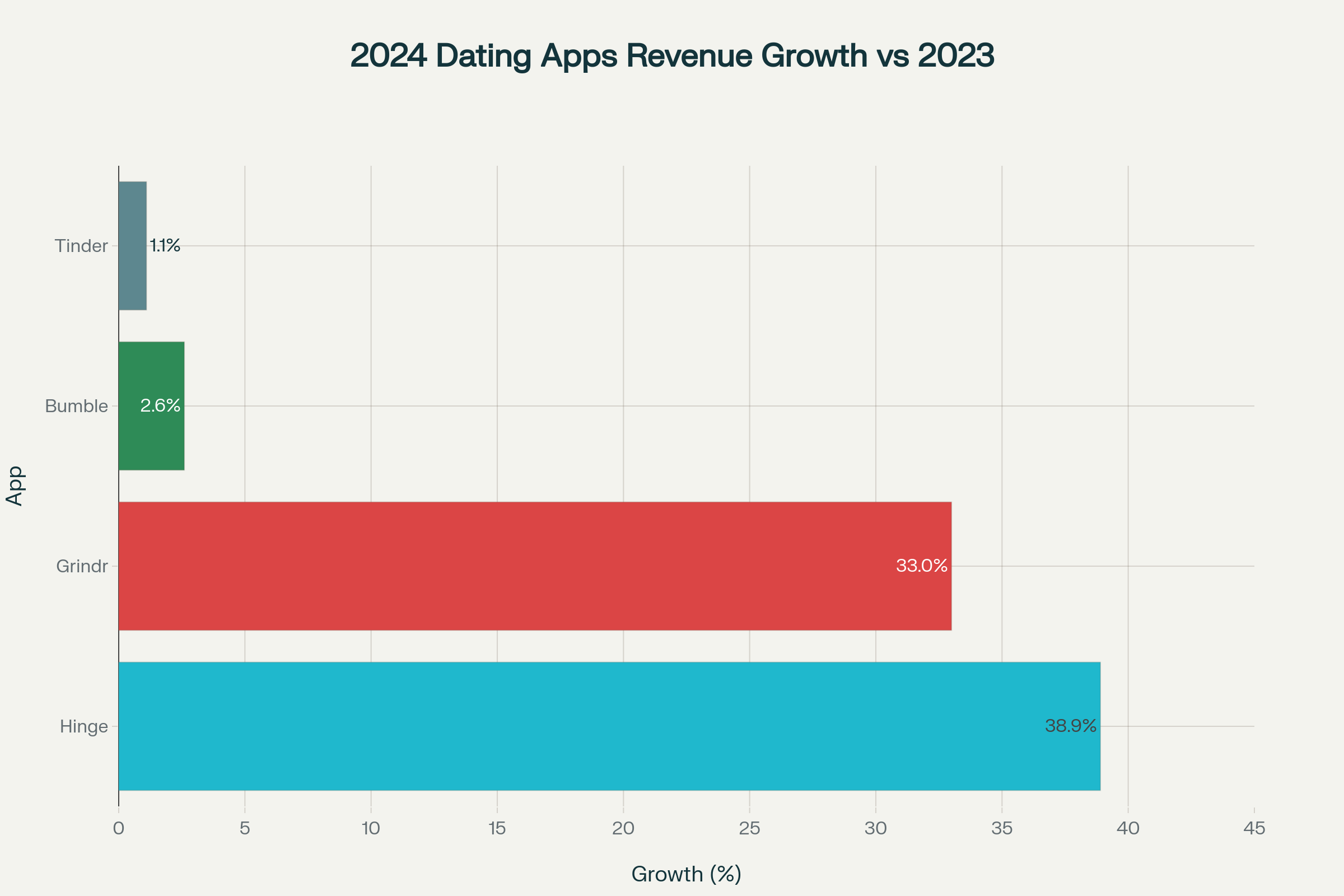

Hinge and Grindr lead 2024 revenue growth, far outpacing more mature rivals Bumble and Tinder

Key 2024 takeaways

- Hinge revenue jumped to $550 million, up 38.9% YoY on just 30 million users—proof long-term-relationship positioning can monetise strongly.

- Grindr surged 33% to $345 million, lifted by ads (+56%) and new AI-powered premium tiers, while maintaining a 43% EBITDA margin and announcing a $500 million buyback.

- Bumble hit $866 million but eked out only 2.6% growth; payer growth slowed and stock re-rated downward.

- Tinder remains the cash machine—$1.94 billion, yet grew just 1%, losing 1.3 million net subscribers amid price hikes and competition.

3. Which Apps Excel at Different Goals?

Survey & panel data (Pew, PCMag, MU-IQ, SSRS) highlight divergent user outcomes:

3.1 Serious Relationships & Marriage

- eHarmony and Hinge top marriage conversion. In a Pew-linked study of 4,000 couples, eHarmony produced a 7% first-year marriage rate, highest among all apps.

- Hinge’s “designed to be deleted” mantra resonates: 70% of its users seek a long-term partner, edging Bumble and eHarmony at 69-70%.

- PNAS longitudinal data (19,131 marriages) show online-met marriages overall have slightly higher satisfaction and lower breakup rates (5.96%) than offline (7.67%), with eHarmony couples rating best.

3.2 Casual Dating & Hookups

- Tinder still leads casual intent: 23–24% of its users report seeking non-committal meetings vs. 14% on Bumble and 8% on Hinge.

- Grindr remains unmatched for real-time, location-based meetups among gay men; 62% of LGBTQ men report using it vs. 60% for Tinder among LGBTQ women.

3.3 User Satisfaction & Safety

- MU-IQ’s 2024 benchmark of seven major apps put Match.com highest in trust—but only at the 18th percentile; overall trust scores were abysmal (5th percentile average).

- 91% of U.S. women want stronger in-app safety controls, and 75% believe platforms must do more. Bumble’s photo-verification and private-detector AI score best in perceived safety (52% safe) versus Tinder’s 37%.

- Grindr rolled out profile identity verification and “Right Now” real-time consent cues, helping retain 14 million MAU with 25% weekly use of the new feature.

3.4 Mental-Health Impact

- National two-wave panel (N = 521) shows users who perceive low “app success” feel significantly lonelier and less satisfied; women report more success but higher anxiety.

- Compulsive use correlates with depressive affect; however, relationship-seeking motives raise joviality when matches succeed. Hinge and Bumble’s limited-like design mitigates burnout versus infinite-scroll Tinder, where choice overload boosts loneliness.

4. Monetisation Trends Shaping 2025

- AI Concierge & Voice: Bumble’s in-test “dating concierge,” Grindr’s “A-List” AI premium layer, and Hinge’s Voice Prompts drive willingness to pay for curation and authenticity.

- Weekly Micro-Subscriptions: Appfigures data show a pivot to short-cycle paid boosts, lifting ARPPU despite slower subscriber growth.

- Contextual Ads & Health Services: Grindr’s indirect revenue (ads/data) grew 85% YoY; the firm is beta-launching wellness partnerships (PrEP, travel) as new revenue streams.

- Price Discrimination: Tinder continues age-tiered pricing ($14.99 under-30 vs. $29.99 30+), though regulators watch for fairness.

5. Demographic Shifts

- Generation Z (18-24) now makes up 53% of U.S. dating-app users; they value authenticity videos and “soft quitting” trends (“micro-mance” vs. grand gestures).

- Millennials (25-34) still dominate paying tiers: 50% of Match Group revenue comes from this cohort.

- Diversity: 39% of new U.S. marriages in 2023 began online and include a record 30% interracial rate, attributed to dating apps expanding choice sets.

6. What “Works Best” in 2025—App-by-App Scorecard

| Goal | Best-performing App(s) | Supporting Metrics |

|---|---|---|

| Marriage likelihood & satisfaction | eHarmony, Hinge | Highest marriage & relationship-satisfaction scores; 26% lower divorce risk |

| Fast revenue & user growth | Hinge, Grindr | 38.9% & 33% YoY revenue gains; >15% payer growth |

| LGBTQ+ community focus | Grindr | 14 M MAU; 62% of LGBTQ men use; ads + wellness roadmap |

| Women-first design | Bumble | 71% of users seeking long-term; top safety perception (52%) |

| Casual swiping volume | Tinder | 75 M MAU; 4 B daily swipes; 1.5 M weekly dates |

| Over-50 serious dating | SilverSingles, Match | 69% of users 50+ seeking LTR; Match leads trust scores |

7. Forward Outlook

- Growth pockets: Niche faith-based and ethical-non-monogamy platforms, plus Asia-Pacific expansion (rapid smartphone penetration, 20% CAGR forecast).

- Regulation & Safety: EU Digital Services Act could mandate age-/ID-verification and algorithm transparency, pressuring Tinder-style popularity ranking.

- AI-driven personalization: Expect hybrid human-AI matchmaking (voice-tone analysis, psychometric prompts) and “simulation dating” to triage matches before meeting.

- Financial KPI consensus: Analysts project 20-25% CAGR for Grindr through 2027 and mid-teens for Hinge; Bumble forecast single-digit until product refresh.

Conclusion

In 2025, “best” depends on your aim:

- Looking for marriage? Data favour eHarmony or Hinge.

- Seeking inclusive LGBTQ+ space? Grindr’s ecosystem leads.

- Want maximum match volume or casual fun? Tinder still rules sheer scale.

- Prioritise female-first control and social-justice lens? Bumble wins.

For investors, the momentum clearly tilts toward Hinge’s high-ARPU relationship niche and Grindr’s monetising underserved LGBTQ+ community. For users, the lesson is to pick the platform aligned with your relationship intent—and stay mindful of safety practices and subscription creep.

Note on Methods: Revenue and growth figures derive from audited filings and industry trackers (Business of Apps, Statista, Match Group, Grindr Inc.). User satisfaction and safety insights synthesize peer-reviewed studies (PNAS, Social Sciences, Cyberpsychology) and large-scale surveys (Pew 2023-25, PCMag 2025 Readers’ Choice, SSRS 2025).